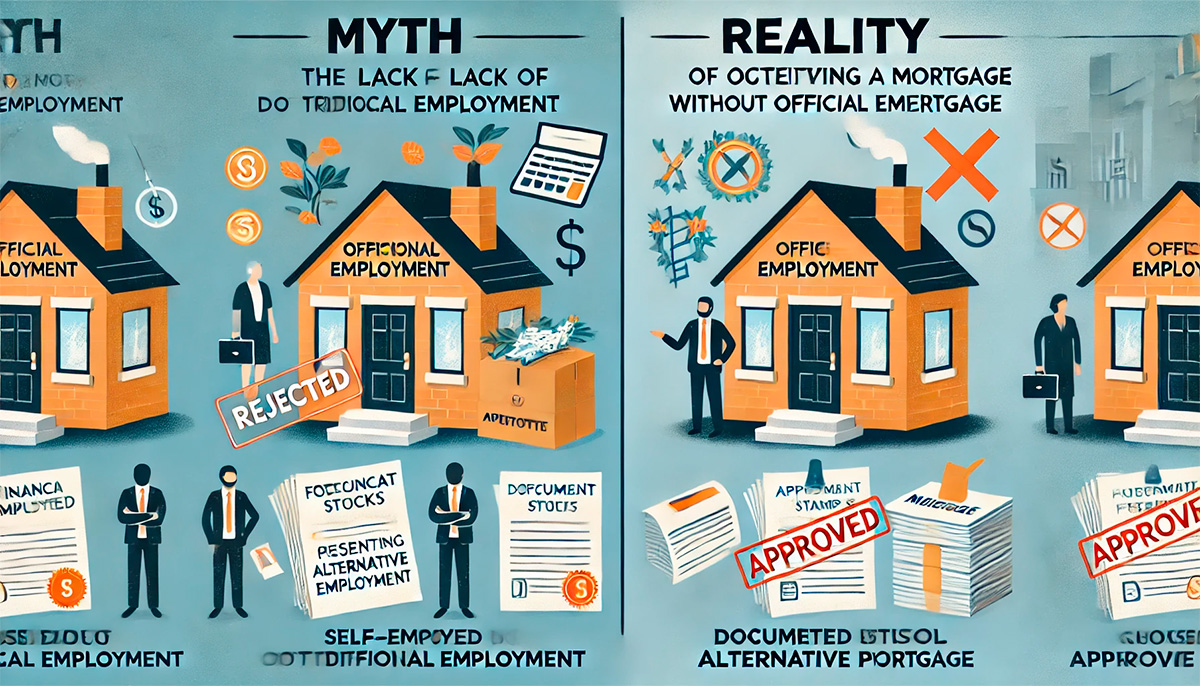

In the labyrinth of modern finance, the dream of homeownership often feels like a distant mirage, especially for those without the traditional trappings of employment. The question lingers in the minds of many: is getting a mortgage without official employment a myth or a reality? The answer, much like the world of finance itself, is nuanced and layered. Let us embark on a journey to unravel this enigma, exploring the possibilities, challenges, and strategies that lie within.

At first glance, the idea of securing a mortgage without a steady paycheck from an employer seems far-fetched. After all, banks and lending institutions have long relied on employment status as a cornerstone of their risk assessment. However, the financial landscape is evolving, and with it, the pathways to homeownership are becoming more diverse. The key lies in understanding the alternatives and presenting oneself as a credible borrower, even in the absence of traditional employment.

The Changing Face of Employment

In today’s gig economy, the concept of employment has undergone a significant transformation. Freelancers, entrepreneurs, and independent contractors now form a substantial portion of the workforce. These individuals often enjoy greater flexibility and autonomy, but their income streams can be irregular and unpredictable. For lenders, this poses a challenge: how to assess the creditworthiness of someone without a conventional job?

Interestingly, the very nature of this challenge has spurred innovation in the mortgage industry. Lenders are increasingly recognizing that traditional employment is not the sole indicator of financial stability. Instead, they are beginning to consider a broader range of factors, such as consistent income over time, a strong credit history, and substantial savings. This shift opens the door for those without official employment to demonstrate their ability to repay a mortgage.

Proving Your Financial Mettle

For individuals seeking a mortgage without official employment, the burden of proof lies in showcasing financial reliability. One of the most effective ways to do this is by providing a detailed record of income. Freelancers and self-employed individuals, for instance, can present tax returns, bank statements, and invoices to illustrate a steady flow of earnings. This documentation serves as a testament to their financial health, reassuring lenders of their capacity to meet mortgage obligations.

Moreover, a robust credit score can significantly bolster one’s case. A high credit score reflects a history of responsible financial behavior, making lenders more inclined to extend credit. It is advisable for potential borrowers to review their credit reports, rectify any discrepancies, and take steps to improve their scores before applying for a mortgage. In the realm of lending, a stellar credit score can often speak louder than a traditional employment contract.

Alternative Income Sources

Beyond traditional employment, there exists a myriad of income sources that can support a mortgage application. Investments, rental income, and even alimony or child support can be considered by lenders. The crucial factor is the consistency and reliability of these income streams. For instance, a well-diversified investment portfolio that generates regular returns can be a compelling argument for financial stability.

Additionally, some lenders offer specialized mortgage products tailored to non-traditional borrowers. These products may have different eligibility criteria, such as higher down payments or slightly elevated interest rates, but they provide a viable route to homeownership for those without official employment. It is worth exploring these options and consulting with mortgage brokers who have experience in navigating the complexities of non-traditional income scenarios.

The Role of Savings and Assets

In the absence of a steady paycheck, substantial savings and assets can play a pivotal role in securing a mortgage. A sizable down payment not only reduces the loan amount but also demonstrates financial prudence and commitment. Lenders are more likely to view such borrowers favorably, as a significant down payment mitigates their risk.

Furthermore, owning assets such as real estate, vehicles, or valuable personal property can serve as collateral, providing an additional layer of security for the lender. In some cases, borrowers may opt for asset-based lending, where the mortgage is secured against the value of their assets. This approach can be particularly advantageous for those with substantial wealth but irregular income.

Building a Strong Financial Narrative

Ultimately, getting a mortgage without official employment hinges on the ability to craft a compelling financial narrative. This involves not only presenting concrete evidence of income and assets but also articulating a clear and coherent story of financial responsibility. Borrowers must be prepared to explain any gaps in employment, fluctuations in income, and the steps they have taken to ensure financial stability.

Transparency is key. Lenders appreciate borrowers who are upfront about their financial situation and proactive in addressing potential concerns. By providing a comprehensive picture of their financial health, individuals without official employment can build trust and credibility with lenders, paving the way for a successful mortgage application.

Conclusion: Myth or Reality?

So, is getting a mortgage without official employment a myth or a reality? The answer lies in the intersection of preparation, innovation, and perseverance. While the path may be more intricate and demanding, it is by no means insurmountable. The evolving financial landscape, coupled with a proactive approach to demonstrating financial stability, makes homeownership attainable for a broader spectrum of individuals.

In the end, the dream of owning a home is not confined to those with traditional employment. With the right strategies and a steadfast commitment to financial responsibility, the keys to your dream home can be within reach, even without a conventional paycheck. The myth, it seems, is steadily giving way to reality.

As we navigate this ever-changing financial terrain, it is essential to remain informed and adaptable. The journey to homeownership may require creativity and resilience, but the rewards are immeasurable. Whether you are a freelancer, an entrepreneur, or someone with unconventional income sources, the possibility of securing a mortgage is within your grasp. The key is to approach the process with diligence, transparency, and a clear understanding of your financial standing.

In the grand tapestry of life, homeownership represents stability, security, and a place to call your own. It is a dream worth pursuing, regardless of the path you take to achieve it. So, take heart, arm yourself with knowledge, and step confidently toward the reality of getting a mortgage without official employment. The myth is fading, and the future is bright for those who dare to dream.